It’s definitely possible to build wealth, even if you didn’t start out rich. Building wealth is something that anyone can do with the correct information and tools. According to Thomas J. Stanley, author of “The Millionaire Next Door,” at least 80% of millionaires in the United States are self-made.

This means they didn’t inherit their wealth, but rather took specific steps to achieve financial independence. If you’re interested in building wealth, you must do a few key things. This BuildSavings guide will provide ways for you to make a fortune for your future self.

How to build wealth in 7 simple steps

In 2018, households in the US had $98 trillion in net worth. That sounds like a lot, but what about people who don’t have any retirement savings or who are still paying off their mortgage? How can they start building wealth?

Rather than looking for get-rich-quick schemes, we advise building your wealth over time. Here are seven steps to help you get started on the path to financial independence.

1. Set financial goals

The first step to building wealth is setting financial goals. Without goals or a financial plan, you’ll have no idea how much money you need to save or invest. Sit down and think about what you want to achieve financially.

Do you want to have retirement savings? Buy a home? Start your own business? Set a number to these goals so you know exactly what you’re working towards. Once you have some goals in mind, you can start working on improving your financial life by making sound financial decisions.

2. Follow a budget

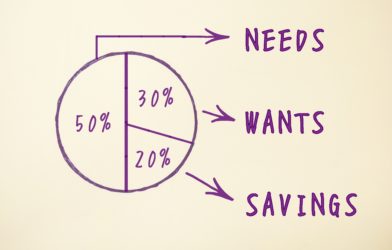

The second step to building wealth is creating a budget and following it. By tracking expenses and following a plan, a budget makes it easier to pay for basic needs, build an emergency fund, and save more money.

Start by tracking your income and expenses for one month. Then, create a budget that allocates your income to your essential costs and savings. Make sure to stick to your budget to save money each month.

3. Save, save, save

To build up your fortune, you must open a savings account and start saving money. Most certified financial planners recommend a savings rate of at least 10% of your income, if not more. This may seem like a lot, but it’s essential to start saving for the future as early as possible. Remember, if you save more, you will be able to build wealth faster.

If you can’t afford to save 10%, start with 5% or even 1%. The important thing is that you’re trying to save money each month. Once you have some saved up, you can start investing in the stock market or other financial products and watch your wealth grow.

It is also a good idea to open retirement accounts, especially if your employer offers a free 401k match. You can also automate your savings by setting up a direct deposit from your paycheck into your savings account. This way, you won’t have to think about transferring money each month – it will happen automatically.

4. Build an emergency fund

In order to secure your financial health in the face of emergencies, you must build an emergency fund. This will help you cover unexpected expenses if you lose your job or have a medical emergency.

Aim to save enough money to cover 3-6 months of living expenses. This may seem like a lot, but having an emergency savings fund is essential for facing tough times and continuing to build wealth. Securing your financial situation by having extra cash on hand will help you sleep better at night and feel more confident about your future.

5. Invest money wisely

Investing is one of the most important things you can do if you want to build wealth. When you invest, you’re essentially putting your money into something that has the potential to grow over time, such as the stock market, real estate, or bonds. If you’re unsure where to start, you may want to seek help from an investment advisor to help you learn about investing.

You can begin by learning about the stock market and start by buying stocks. Another investment you can explore is mutual funds. They are a collection of various stocks or bonds, which can be less risky than investing in individual stocks.

However, be sure to avoid high fees when investing. Look for an investment account with low expense ratios and avoid hidden costs, such as loads and 12b-1 fees. A diversified portfolio is also essential, so don’t put all your eggs in one basket.

6. Avoid and pay off high-interest debt

To build wealth over time, avoiding and paying off high-interest debt is crucial. Paying off your debts from highest to lowest interest is referred to as the debt avalanche method of debt repayment.

This includes credit card debt, student loan debt, car loans, and personal loans with high-interest rates. These types of debt can quickly eat away at your savings and cause you to fall behind financially.

Paying off debt can be a long and challenging process, but it’s a way for you to have financial security and peace of mind. Start paying off your debt as soon as possible so that you can start building wealth. Also be sure to avoid taking on new debts that will prevent you from building wealth.

7. Increase your income

When it comes to saving, investing, and paying off debt, you may not have enough income right now to do it all. If you can find ways to bring in additional income, you’ll be on your way to becoming wealthy.

There are several ways to do this, such as starting a side hustle or working overtime to earn more money. Making more money is a great way to hasten the wealth-building process.

Tips to grow wealth

Growing your wealth is a marathon, not a sprint. These tips will help make the process more enjoyable:

Be patient

It takes time to build wealth, so patience is essential. Do not get discouraged if you don’t see results immediately. Remember that Rome wasn’t built in a day, and your wealth won’t be either. Keep at it – eventually you’ll see your hard work pay off.

Start small

The vast majority of millionaires are self-made and started small. They didn’t have much money, to begin with, but they made the most of what they had. You can do the same. Start small and gradually grow your wealth over time.

Create good habits

Creating good habits is essential to success, including building wealth. Good practices include saving regularly, investing wisely, and staying out of debt. Once you practice these habits, they’ll become second nature and help you reach your financial goals.

Set realistic expectations

It’s essential to set realistic expectations when it comes to building wealth. You will likely be disappointed if you expect to become a millionaire overnight. Not everyone can build wealth fast. It takes time, effort, and patience to build wealth.

Final thoughts on wealth building

Wealth doesn’t just provide you with money to buy stuff, it gives you freedom and control over your life. But building wealth means putting in the time, patience, and perseverance to reach your goal.

It is essential to invest in financial education so you can continue to grow your wealth. Whether you want to create accumulated wealth through real estate investing, bolstering your retirement account, buying mutual fund shares, or picking and investing in particular stocks, you need to have a plan.

Consider hiring a certified financial planner to help you with retirement planning or creating a custom portfolio. Many robo-advisors and brokerage services are also available to help keep your investing simple. Finally, just get started. By following the advice in this article, you’ll be well on your way to financial success.