Sure, you’ve heard of a 401k before, but what does that assortment of numbers and letters even mean? You want to make sure you don’t miss out on valuable retirement savings, but you’re probably not a tax accountant. You’re not alone, many people find it can be hard to comprehend 401k plans and even harder to make the right decisions about them.

Making the wrong decision about your 401k can cost you tens of thousands of dollars in retirement savings. This beginner’s guide to understanding 401k plans will take the guesswork out of making the right choices for your future. We’ll explain everything you need to know, from how a 401k works to defining the annual contribution limit.

401k meaning

A 401(k) – or 401k – is an employer-sponsored retirement account that many employers offer in the United States. It lets you save and invest towards your retirement plans in a tax-deferred way.

“401(k)” refers to the section of the tax code that governs these types of tax-advantaged retirement saving accounts.

Benefits of a 401k plan

Many employers encourage their employees to save for retirement through 401(k) plans since they can make pre-tax contributions. This reduces the employees’ taxable income in the current year, which can result in a lower tax bill. Additionally, 401(k) contributions grow tax-deferred, meaning you won’t pay taxes on the investment gains until you withdraw the money in retirement.

Depending on your employer, you may get matching contributions from the company you work for, which can be an excellent benefit. For example, your employer might contribute to your 401(k) in an amount equal to to first 5% of your personal contributions to your 401(k) from your paycheck. Additionally, 401(k) plans offer other benefits such as loan provisions and hardship withdrawals.

How does a 401k plan work?

To contribute to a 401k, an employee would have part of their paycheck withheld and contributed to their 401k plan, instead of going to their bank account. The money will then be invested in various investments, such as stocks, bonds, and mutual funds, that the employee chooses from the options available in their particular retirement plan.

If your company does offer employer contributions that are dependent on the amount of the employee’s contribution, it is a good idea to contribute at least the minimum amount of money required to get the full match. This way you are not leaving any part of your compensation on the table.

Traditional 401k vs. Roth 401ks

There are two types of 401k plans: Roth and traditional. They have different rules and benefits, so it’s essential to understand them. Not all employers offer Roth 401ks retirement plans, but most will offer traditional plans.

- Traditional 401k

The employee contributes pre-tax dollars to their accounts through a traditional 401(k) plan. This reduces their taxable income in the current year, which can result in a lower tax bill. The money is then invested and grows tax deferred.

This means you won’t have to pay taxes on the investment gains until you withdraw the money in retirement. Often, your tax rate in retirement will be lower than it is during your working years, because you will be earning less income.

- Roth 401k

With a Roth 401(k) plan, an employee’s contributions are made after they are taxed on their income. This means they will not get a tax break in the current year, but the money will grow tax deferred. You won’t need to pay your taxes on the withdrawals you make in retirement. This can benefit you if you expect to be in a higher tax bracket in retirement than you are now.

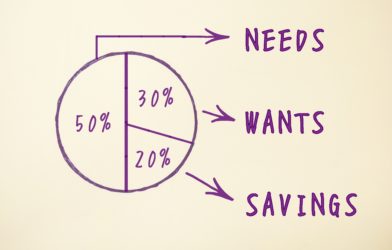

How much to contribute to your 401k

You will have to decide how much you want to contribute to your 401k retirement account. You can have a certain percentage of your paycheck withheld and contributed to your 401(k) plan.

Most financial experts recommend contributing at least enough to get the employer match if one is offered. If your employer offers you a 3% match, you should contribute at least 3% of your paycheck to get the full benefit.

However, you can contribute up to 100% of your paycheck or the annual contribution limit, whichever is lower.

401k plan contribution limits

The 401(k) contribution limit is the maximum amount of money you can contribute to your 401k plan in a year. If you contribute over the limit, you have until you file taxes for that year to withdraw the overage and any earnings on it, or you’re subject to a penalty of 6% of the overage each year until it’s fixed.

For 2022, the contribution limit for the 401(k) account owners is $20,500. If you’re over the age of 50, you may be able to make catch-up contributions.

Catch-up contributions are additional contributions you can make to your 401(k) plan above the normal contribution limit for those nearing retirement age. An additional $6,500 catch-up contribution is permitted if you’re over 50 years old.

401k Investment Tips

When choosing your investments within your 401(k) plan, you’ll need to consider your investment goals and risk tolerance. Your investment options will depend on the particular 401(k) plan offered by your employer. Some plans only offer a limited selection of mutual funds while others offer a wide variety of investment choices, including stocks, bonds, and exchange-traded funds (ETFs).

Often, 401ks will offer target date funds. Target date funds are a type of asset allocation fund that automatically rebalances your investments as you approach retirement. They are generally considered to be a good option for those who don’t want to actively manage their investments.

Another thing to consider is the fees associated with the investments in your 401(k) plan. Some plans have high fees which can eat into your investment returns. Be sure to check the fees before you invest in any 401(k) plan.

If you’re not sure where to start, you can consult with a financial advisor to help you create an investment plan that meets your needs.

How to get money from a 401(k)?

Once you are retired or ready to leave your job, you can begin withdrawing money from your 401(k) plan. There are generally three ways to get money from your 401k: loans, hardship withdrawals, and distributions.

- Loans

Before you take a withdrawal from your 401k, consider taking a loan from your 401k. There are many rules around this, including the amount you can borrow and the repayment terms. The loan must be repaid within five years, unless it’s used to purchase a home, in which case the repayment period is extended to 10-15 years.

If you don’t repay the loan as agreed, it will be treated as a distribution and subject to income taxes and possible early withdrawal penalties.

- Hardship Withdrawals

Early withdrawals done before retirement age are typically only allowed in financial hardship, such as medical expenses or unemployment. Hardship withdrawals are subject to income taxes and may also be subject to a 10% early withdrawal penalty.

- Distributions

Distributions are the most common type of withdrawal from a 401(k) plan. Once you reach retirement age (which is typically 59.5), you can begin taking distributions from your 401(k) individual retirement account. Distributions are subject to income taxes, but they are not subject to the 10% early withdrawal penalty.

When you reach the age of 72, you must take required minimum distributions each year from your 401k or face hefty penalties (50% of what you were required to take) and additional taxes.

How to start a 401k

Talking to your employer is the best place to start if you’re interested in opening a 401k account. Many employers offer 401k retirement savings plans to their employees, so usually the HR department can help you get set up. If you’re self-employed, you can open a Solo 401k.

Key takeaways

A 401k plan is a retirement savings plan sponsored by an employer. It’s a great way to save for retirement, and the earlier you start contributing, the better. Some employers even offer to match a portion of employee contributions.

Be sure to check the fees associated with your 401k investment choices before you invest, as high fees can reduce your investment returns. You can begin withdrawing money from your 401k once you reach retirement age, but there may be penalties for early withdrawals. If you need help creating a retirement savings strategy, it may be prudent to engage a financial advisor.