Figuring out how much to save for retirement can be confusing. You might not know where to start or how much you need to save each month.

It’s never too late to start saving for retirement, but the sooner you start, the better off you’ll be. Depending on your age, there are different benchmarks you should aim for.

Follow our tips on how to get started building your retirement nest egg today.

How much should you save for retirement?

The amount you need to save for retirement depends on a number of factors, including your current age, income, desired retirement lifestyle, and how long you plan to work.

The 15% rule of thumb

According to research from the Center for Retirement Research (CRR) at Boston College, you should save at least 15% of your salary for retirement. This is a commonly recommended figure by financial advisors and institutions. However, this is just a rule of thumb, since 15% may be more than you need if you are a low income household or not enough if you start saving late.

Additionally, the CRR’s figures are from 2014 and are based on assumptions around Social Security income (SSI) in retirement and annuity income. Since your circumstances might be different based on your expected additional sources of income in retirement (including SSI or pensions), it can be easier to get a feel for how much you should save by looking at how much you plan to spend. That’s where the 4% rule of thumb comes in.

The 4% rule of thumb

A more comprehensive way to calculate how much to save for retirement is the 4% rule. Four percent is known as a “safe withdrawal rate,” which means that you can withdraw 4% of your portfolio each year in retirement, adjusting for inflation, and you will not run out of money during a standard 30-year retirement. Again, this rule of thumb may be affected by your life expectancy, because if you live longer, you will need your portfolio to last longer and your medical costs may increase as you age.

To use this rule to calculate how much to save for retirement, you will first figure out how much in annual income you want to retire comfortably. Then to find out what size portfolio you would need to be able to safely withdraw that amount (i.e. a portfolio where your desired annual retirement income is 4%), you will multiply your desired retirement income by 25 (this is the same mathematically as dividing by 0.04).

So, if you want to spend $40,000 per year in retirement, you will need to save a $1 million portfolio. The tricky part of using this rule of thumb is accurately calculating your expenses in retirement. To make this easier, a popular recommendation is to plan for retirement based on your current pre-tax income, since you are presently able to live off of that amount.

When should you start saving?

The earlier you start saving for retirement, the more time your money has to grow. That’s why it’s important to start saving as early as possible, even if you can only afford to set aside a small amount of money each month.

If you’re in your 20s and just starting out in your career, you might not have a lot of extra money to put towards savings. However, even small contributions can add up over time, so it’s important to start saving now.

As you can see in the figure above from the New York Times, investing 10 years earlier could result in an additional $500,000 in retirement. If you start saving for retirement later, you will need to increase your savings rate to be able to reach your retirement goals or decrease your income expectations in retirement.

How do savings differ depending on your age?

Here are some ballpark retirement savings goals based on age, expressed as multiples of salary before retirement, along with an example based on a salary of $50,000. (Source: Fidelity)

- Age 30 – 1x preretirement income saved (i.e. $50,000)

- Age 35 – 2x preretirement income saved (i.e. $100,000)

- Age 40 – 3x preretirement income saved (i.e. $150,000)

- Age 45 – 4x preretirement income saved (i.e. $200,000)

- Age 50 – 6x preretirement income saved (i.e. $250,000)

- Age 55 – 7x preretirement income saved (i.e. $300,000)

- Age 60 – 8x preretirement income saved (i.e. $400,000)

- Age 67 – 10x preretirement income saved (i.e. $500,000)

If you are planning to use the 4% rule instead, based on a desired spending of $40,000 per year in retirement, you will need to save twice the amounts listed above for a final portfolio value of $1,000,000.

Keep in mind that these are just guidelines. Your specific savings goal will depend on your unique circumstances. Also don’t worry that you will need to be saving more and more money annually as you approach retirement to reach the greater and greater sums. As long as you are investing your money, compound interest will be helping you grow your nest egg while you continue to save the same amount as you were before.

Additionally, you can push out your retirement date if you feel you are not on track or retire early if you reached your retirement savings number early. Your retirement age is not set in stone, but there are tax implications around when you can and must withdraw funds from tax advantaged retirement accounts.

5 Tips for saving for retirement

1. Budget

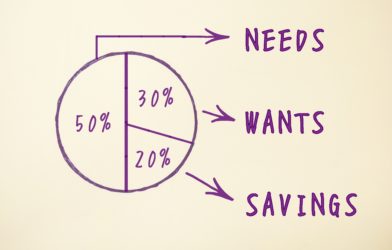

Saving for retirement may seem like a daunting task, but there are several things you can do to make it more manageable. First, start by creating a budget so you know what your expenses are now and you can estimate what your expenses might be in retirement. Be sure to factor in potentially higher future costs, such as healthcare and health insurance. Additionally, some costs may actually decrease, like housing if you pay off your mortgage before retirement.

2. Start saving ASAP

Even if you’re not sure how much to save for retirement each month, start with a small amount and increase it as you can. Even $50 per month can add up over time. And remember, the sooner you start saving, the more time your money has to grow with the power of compound interest.

3. Invest

Investing can seem overwhelming, but it is simple to start by contributing to a 401(k) or another employer-sponsored retirement plan. If your company offers an employer match, be sure to contribute at least enough to get the full company match.

You can also open an individual retirement account (IRA). There are two main types of IRAs: traditional and Roth. With a traditional IRA, you’ll receive a tax deduction for your contributions now, but you’ll pay taxes on the money when you withdraw it in retirement. A Roth IRA doesn’t offer an up-front tax deduction, but your withdrawals will be tax-free in retirement.

4. Consider working with a professional

Consider working with a financial advisor to help you make financial decisions around retirement planning. A professional can help you create a retirement savings plan that meets your unique needs and goals.

They can also help you understand your social security benefits and give you tax advice when it comes to using your tax-advantaged retirement accounts to provide enough income in retirement. Additionally, your investment strategy will change as you approach retirement, and a professional advisor can help you adjust your asset allocation as your risk tolerance and investment objectives change.

5. Stay disciplined

Stay disciplined with your savings plan. Once you’ve set aside money for retirement, resist the urge to spend it on other things. Consistency is key to building a healthy nest egg.

The bottom line

Saving for retirement is one of the most important financial goals you can set for yourself. How much you need to save will depend on how much income you want in retirement and when you plan to retire.

No matter how much you earn, it’s important to start saving for retirement as early as possible. The sooner you start, the more time your money has to grow. And, even if you can only save money a little bit at a time, it will add up over the years you have until retirement

Investing is also key to growing your money so you have enough monthly income in retirement. Consider working with a financial advisor to understand the investing, tax, and social security aspects of a retirement plan.