Learning how to budget properly is crucial to afford the life you want. Even people with a high income can struggle financially without a proper budget in place.

If you’re looking for a step-by-step guide on how to budget to improve your finances and attain financial stability, look no further. By following these simple steps, you’ll be on your way to managing your money.

Benefits of Budgeting

A budget is a plan that can help you track your income and costs to make more informed financial decisions. Below are some of the many benefits of creating and sticking to a budget.

- Save money

Budgeting can help you save your funds to ensure your bank account continues to grow. Using a budget to manage your finances gives you an opportunity to cut back spending so you can increase your savings.

- Avoid debt

A budget can also help you avoid accumulating debt by allowing you to track your spending habits and make sure you are not spending more than you earn. With a budget, you can get a bird’s eye view of your debt and create a better plan for eliminating it altogether.

- Focus on your goals

Setting goals like saving for vacation or a down payment for a house can be achieved with the help of a well-prepared budget. Goal setting is a great way to stay on track with your budget, because seeing progress towards your goals will keep you motivated to continue managing your money.

- Live below your means

One of the biggest financial mistakes people make is living outside of their means. Budgeting can assist you in living within your means by setting guidelines for your expenses, so you’re only spending money on what is necessary.

- Less stress and anxiety

Money woes are one of the leading causes of stress. A budget helps ease your stress and anxiety by giving you a clear picture of your finances and providing a plan to reach your financial goals.

Get Started Budgeting

According to a 2021 study, at least 86% of Americans are now keeping track of their expenses and income. Join the ranks of these budgeters by following these steps that walk you through how to budget.

- Determine Your Income

Write down all sources of monthly income, including your paycheck, investments, and other money that comes into your household. It can help to start by gathering the necessary financial documents, such as your paystubs or bank statements. - Calculate Monthly Expenses

This includes your monthly cost of living, such as your housing costs, food, transportation, childcare, health insurance, and taxes. Your expenses also include debt payments, utility and medical bills, and other recurring and one-time costs. - Compare Income and Expenses

Subtract your expenses from your net (after-tax) income. This will help you grasp your spending habits and encourage you to make sure your costs do not exceed your regular income. Also, this enables you to determine your spending limit. - Set Goals

Determine how much money you want to save each month and what you want to use the cash for, such as retirement, an emergency fund, or a large purchase. You can immediately set money aside to pay bills and other fixed and variable expenses in this step. - Pick a budgeting method

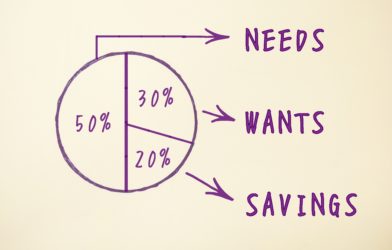

There are plenty of budgeting methods to choose from, whether you want to use an app on your phone, a budget binder, or a simple pen and paper budgeting method. Ultimately, you have to find what works best for you. Some examples include envelope stuffing, a budgeting app such as You Need a Budget, or the 50/30/20 method. - Track your spending

A budget is designed to help you grow and learn from your own habits. Staying committed to your budget can help you analyze your spending patterns to understand where your money is going and whether your spending aligns with your goals in life. - Make Adjustments

To make the most of your budget, it’s important to stay on top of it and make adjustments as you go along. Budgets are meant to grow with you and your goals, so remember that you may need to adjust your budget throughout the year as your circumstances change. Maybe your income will increase or your spending will decrease – these changes should always be reflected in your budget. - Review the budget regularly

It is vital to review your budget regularly to ensure it is still relevant and accurate. Your financial priorities or circumstances may have changed, requiring you to adjust your budget. Additionally, if you forget to review your budget, you won’t have a good idea of how much you are spending and might fall off track.

Budgeting Best Practices

Budgeting helps you take control of your spending and ultimately reach your financial goals. Achieve your money goals with these practical budgeting tips.

- Make a realistic budget

In order for your budget to work, it needs to be realistic. Use your take-home pay as a reference and check your accounts to make sure you are not budgeting more money than you have.

- Be specific with your budget

Include your total income, debts, and variable expenses in your personal or household budget. The more you break down your spending, the easier it will become to see where you can cut back to save some money.

- Create a buffer in your budget

Create a buffer in your budget by saving an emergency fund for unexpected expenses. This will help you avoid dipping into your savings or going into debt when something urgent and unexpected comes up.

- Set aside money for your goals

Plan how your money can help you live the life you want and set aside money for your long-term goals. Popular goals are saving for retirement, a down payment on a house, or a new car.

How to stick to your budget

It may be challenging to follow your budget, especially if you have never done it before. But things will go more smoothly with the following tips.

- Create a simple system that suits you and that you enjoy using.

- Be mindful of your spending and make sure every purchase is necessary.

- Communicate with your family and friends about your budget so they can support you.

- Use coupons or comparison shopping to save money on your regular expenses.

Don’t be afraid to seek professional help when it comes to budgeting. You may want to hire a financial advisor or a money coach to help you develop a budget that works for you.

Budgeting FAQs:

How much should I save each month?

As a general rule, you should save at least 10% of your salary each month. Depending on your income, you may be able to afford more, which can help you reach your goals more quickly.

What are the best budgeting apps?

Many budgeting apps are available and the best one for you will depend on your needs. Some of the most popular include Mint, You Need a Budget (YNAB), and EveryDollar. These apps can help you manage your personal finances with minimal effort, whether you want to track your personal or household’s spending.

What are the priorities in budgeting?

Some expenses are non-negotiable, like your rent, your food, or debt minimum payments, while others are optional like clothing and travel. To prioritize your spending, create a list of your monthly expenses and order them from most to least important. This will help you figure out where to cut back if necessary.

Final Thoughts

If you are one of the 38% of employees in the US that still live paycheck to paycheck, learning how to budget can help you take control of your finances and create a brighter financial future. Although there is no one-size-fits-all solution to budgeting, you can follow a few simple steps to create a budget that will work for you. Don’t wait any longer, get started with a simple budget today.