Inflation is one of the most important economic concepts, yet it can be hard to find an easy-to-understand definition and explanation of this concept. Inflation is a complex economic phenomenon that can seriously affect individuals and businesses. Recently, various analysts and investors have expressed worry about the possibility of inflationary pressures in the economy.

Inflation can significantly impact your finances, but it’s not always easy to understand what’s happening with prices. In fact, with the annual inflation rate in the U.S. unexpectedly increasing to 8.6% in May 2022, as opposed to the projected 8.3%, there is a heightened concern about inflation.

Especially since the monetary policy tools of the Federal Reserve Bank seem to be unable to effectively address this problem, it is essential to understand what inflation is and how it works. You’ll be better equipped to understand how the economy works by understanding inflation.

Inflation meaning

Inflation is the rate at which the prices of goods and services increase over time. This means that the purchasing power of a unit of currency (such as the U.S. dollar) decreases over time. As the commodity price increases, each unit of currency buys fewer goods and services.

In simple terms, over time your money is worth less, so you have to spend more than you did in the past for the same products and services.

Inflation is a normal phenomenon in an economy, but it can have harmful if it occurs at an uncontrolled or excessive rate. When inflation is too high, it can lead to economic problems such as stagflation (a period of both high inflation and unemployment) or even hyperinflation (a situation where prices rise so rapidly that even banks may lose purchasing power).

Inflation directly affects economic growth, interest rates of central banks, job creation, and wages. It also impacts the cost of living, housing and gas prices, and stock prices. As a result, it is essential to clearly understand what inflation is to make informed economic decisions.

Inflation vs. deflation

Inflation and deflation are opposite phenomena. Inflation is an increase in the prices of goods and services, while deflation is when commodity prices decline. Both are effects of how fast the money supply grows or shrinks. While inflation can harm an economy, deflation can be even more damaging.

In a deflationary environment, people may start to hoard cash because they expect prices of financial assets, goods and services to decline in the future. This can lead to decreased consumption and investment and an economic recession. In deflation, the money supply can also contract, leading to a decrease in the speed at which money changes hands in the economy, negatively affecting the overall economy.

Measuring inflation

Economists use various methods to gauge the level of inflation in an economy. One of these measures is called the price index.

A price index is a statistical measure that shows how price changes over time. The Consumer Price Index or the CPI, produced by the Bureau of Labor Statistics (BLS), is the most often used and followed indicator of determining inflation in the United States.

The Consumer Price Index is a measurement of the average price changes paid by urban consumers for a market basket of consumer goods and services. The CPI market basket includes over 200 items, such as food, housing, clothing, oil prices, medical care, and recreation.

A producer price index or PPI (also produced by the BLS), on the other hand, tracks the average change in selling prices that domestic producers get for their output over time. For many goods and services, the PPI prices come from the first commercial transaction.

Then, there’s the wholesale price index or WPI, which measures the cost of items at the wholesale level, or those traded between businesses rather than consumers, and sold in large quantities. Some international economies use the WPI as a gauge of core inflation, while the United States uses PPI.

Inflation rate formula

The inflation rate is the rate at which inflation rose over time. This rate displays the relationship between currency value and the cost of goods and services. In calculating inflation rates or consumer price inflation, the following formula is used:

Inflation Rate = (Current Year’s CPI – Last Year’s CPI)/Previous Year’s CPI) x 100

For example, if the CPI in 2016 was 102 and the CPI in 2015 was 100, then the inflation rate would be (102-100)/100) x 100 = 2%.

What causes inflation?

Various factors cause inflation, but the most common cause is an increase in the money supply. When the money supply increases, more money is chasing the same number of goods and services, leading to higher prices and causing inflation.

Overall, there are three types of inflation:

- Cost-push inflation

Cost-push inflation occurs when there is an increase in the production costs, which leads producers to raise prices of commodities. This can be caused by an increase in the price of raw materials, such as oil, or by increased wages.

- Demand-pull inflation

Demand-pull inflation occurs when there is an increase in demand for goods and services, and prices rise because the current supply cannot meet the demand. Demand-pull inflation can be caused by an increase in population or government spending.

- Built-in inflation

Built-in inflation refers to the cycle where inflation increases the cost of living, and workers therefore expect a corresponding increase in pay. This type of inflation is difficult to control because it is not caused by an increase in the money supply or demand for products but by inflation expectations.

Effects on the economy

Inflation can have both positive and negative effects on an economy.

Some of the positive effects of inflation include:

- It encourages consumer spending and investing as people expect prices to rise in the future

- It reduces the actual value of debt

- It can help reduce unemployment by stimulating aggregate demand

Some of the adverse effects of inflation include:

- It can lead consumers to lose purchasing power

- It can lead to higher interest rates and increased borrowing costs

- It can cause uncertainty and discourages long-term planning

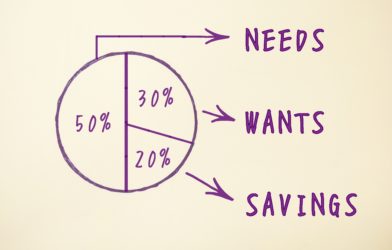

Investments to beat inflation

There are, however, ways to beat both regular and rapid inflation, even for those on fixed incomes. Below are some of the ways you can combat inflation.

- Stocks

One of the best ways to beat inflation is to invest in stocks. Over the long term, stocks have outperformed most other investments, including bonds and cash, giving an average annual return of around 10% which typically outstrips inflation.

- I-Bonds

Another way to beat inflation is to invest in I-bonds, which are government bonds with fixed interest rates for the first 6 months, then variable interest rates every following 6 months based on the inflationary environment (whether inflation or deflation). The value of the bond can never be less than you paid.

- Real estate

Investing in real estate is another way to keep ahead of unpredictable inflation. Real estate has outperformed the stock market over the long term. Additionally, inflation can positively impact your real estate investment since your equity will increase as your mortgage payment stays the same (since inflation improves your loan-to-value ratio).

- Gold

Gold is often thought of as a safe-haven investment, and for a good reason. Gold has been used as a currency and store of value for centuries and still retains its worth today.

- Treasury Inflation-Protected Securities (TIPS)

Treasury inflation-protected securities (TIPS) are a type of bond issued by the United States government. TIPS are designed to protect investors from inflation by providing a higher rate of return when inflation is high.

Key takeaways

Inflation is a critical economic indicator because it reflects the overall health of an economy. When prices increase, there is more demand for goods and services than is currently available. This can be interpreted as economic growth, as businesses must increase production to meet consumer demand.

While high inflation levels may cause short-term problems, they usually indicate a healthy and expanding economy. If you’ve ever wondered why prices seem to go up every year, now you know the answer – the power of inflation.