Would you be surprised to learn that the average Americans’ personal savings rate was just 6% in January 2022? It’s no surprise that people have difficulty reaching their savings goals when they are saving less than 10% of their income. This is where a budget can help you properly allocate your money so you can work towards your financial goals. Are you familiar with the 50/30/20 budgeting rule?

The 50/30/20 budgeting method is a great way to help get your finances in order and start saving for the future. This guide will help you understand how the 50/30/20 budgeting method works and how you can use it to create a monthly budget that fits your unique needs.

What is the 50/30/20 budgeting rule?

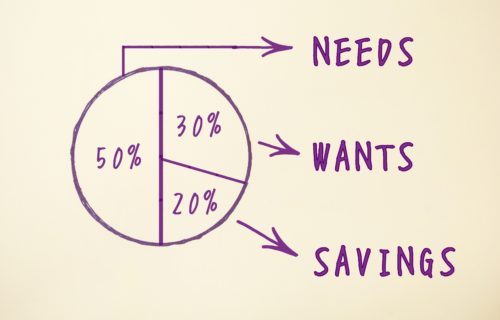

The 50/30/20 rule of thumb is one of the most common budgeting methods that can help you monitor your living expenses to save money and gain financial security. The 50/30/20 rule is a rule of thumb that helps you break down your monthly income into only three major categories.

The three categories are recommended percentages of your after-tax income: 50% to essential expenses, 30% to discretionary spending, and 20% to savings and debt repayment.

Senator Elizabeth Warren proposed this rule of thumb in her 2003 book “All Your Worth: The Ultimate Lifetime Money Plan.” This rule of thumb aims to make it simple to budget in order to achieve your financial goals.

How to use the 50/30/20 budget rule

The 50/30/20 rule is a simple way to make sure that you can cover your essential living expenses and make some discretionary purchases while still saving money. This way, you can still achieve your savings goals, whether you’re socking away emergency savings or retirement savings for the future.

Here’s the breakdown of the three categories of the 50/30/20 budget rule.

50% of Your Income: Essentials

According to the 50/30/20 rule of thumb, 50% of your net pay (also known as your after-tax income) should go towards essential expenses. These are necessary monthly expenses to maintain your quality of life such as:

- housing

- basic groceries

- transportation

- health care or health insurance

- utilities

For example, if your take-home income is $3,000, following the 50/30/20 rule you would allocate $1,500 (50% of $3,000) towards covering your essential living expenses.

30% of Your Income: Wants

Following the 50/30/20 rule of thumb, 30% of your after-tax income is allocated to the things that you want but don’t necessarily need. In order to follow this budget, you may need to change your spending habits and cut out some unnecessary expenses.

Although discretionary spending may not be necessary for your quality of life, it will make you happy. Some discretionary purchases include:

- eating out

- entertainment

- designer clothing

- down payment for a car upgrade

- gifts

- travel

For example, if your monthly income is $3,000, you would have $900 (30% of $3,000) to spend on discretionary items each month.

20% of Your Income: Financial Goals

The remaining 20% of your take-home pay is what you should allocate toward your financial goals. This includes savings and minimum debt payments, as well as extra payments to get out of debt faster.

Financial goals include:

- saving for retirement income or retirement contributions

- investing in stocks, bonds, or mutual funds

- paying off debt, such as credit card debt or student loans

- saving for your child’s education

- building up emergency fund

In terms of emergency funds, financial experts suggest you save at least three to six months’ worth of income in your savings account.

According to the 50/30/20 rule, if your after-tax income is $3,000, you would have $600 (20% of $3,000) to save each month.

Advantages and disadvantages

Following this basic rule for budgeting has helped many people improve their financial lives and save additional money. However, before you decide if it’s a suitable budget method for you, consider the following advantages and disadvantages.

Advantages:

- It is a good rule of thumb that is easy to follow

- It is simple and only involves three categories

- It can help you spend within your means and not overspend

- It can help you reach your financial goals, such as saving for retirement or paying down existing debt

Disadvantages:

- It may be challenging to stick to, especially if you have a lot of expenses

- It may not be realistic for some people, depending on their income and lifestyle

- It is harder to calculate if you have variable income instead of a steady paycheck

How to budget with the 50/30/20 rule

To budget with the 50/30/20 rule, simply follow these 5 steps:

1. Calculate your after-tax income

You will need to calculate your net income. You can use your pay stubs or bank statements to help you calculate your monthly after-tax income.

2. Classify your monthly spending into groups

Once you have your take-home pay, you will need to track and classify your spending into three categories: essential expenses, discretionary expenses, and financial goals.

3. Assess and adjust your spending to correspond to the 50/30/20 rule

Once you have classified your expenses, you will need to assess your spending to see if it aligns with the 50/30/20 rule. If your spending does not align with the 50/30/20 rule, you may need to make some adjustments, such as cancelling subscriptions or eating out less, to ensure that you are not overspending in any category.

4. Make a budget and track your progress regularly.

After assessing your spending and making any necessary adjustments, you will need to create a budget. You can use a budgeting app or a simple Excel spreadsheet to help you track your money. Once you have created your budget, you will need to track your progress regularly to ensure that you stick to your plan.

5. Adjust your budget as needed

As your income and expenses change over time, you must adjust your budget accordingly. For example, you may need to increase your savings goals if you get a raise. Alternatively, you may need to adjust your budget to account for childcare expenses if you have a baby.

Key takeaways

Personal finance concepts like the 50/30/20 rule are popular because they are simple to understand. However, just because this rule of thumb is simple doesn’t mean it’s easy to implement. You may need to take some time to reduce your discretionary and possibly even essential spending to follow this rule of thumb.

You can use the 50/30/20 rule as a general guideline to help create a budget that works for you. Remember, everyone’s financial situation is different, so you may need to adjust the percentages to fit your own needs and your monthly income.

If you’re able to save 20% of your income, that’s triple the average savings rate in America right now, and you’ll be ahead of the curve. It’s never too late to start saving money, so start today.