According to the Transamerica Center for Retirement Studies, the average household has saved around $93,000 for retirement. Whether your savings are above or below average, now is a great time to learn about where to invest for retirement. You should start investing for retirement as soon as possible, whether you’re in your twenties and just getting started or at the height of your career.

It’s important to have a retirement plan, but there are so many different retirement investment techniques and retirement accounts to decide between. This guide will show you how to invest your money to give you the best chance for a comfortable retirement.

Where to invest for retirement: 10 excellent options

The best retirement investment vehicle should meet your goals, which will likely change as you get closer to retirement age. However, there are other factors to consider as well, such as having enough income to cover basic expenses, having money available for healthcare costs, and building generational wealth.

Here are 10 of the best retirement investments to help you reach your goals:

- 401(k), 403(b) or Thrift Savings Plan (TSP)

A 401(k) is a defined contribution plan that allows you to invest on a tax deferred basis. These employer-sponsored retirement plans are offered by most companies, and if you’re self-employed you can open a Solo 401(k). Similar plans in the public sector and federal government are 403(b) and Thrift Savings Plan (TSP). You can contribute pre-tax dollars to your 401(k), which reduces your taxable income.

Additionally, many employers will match employee contributions, which effectively give you free money in addition to the money you’re saving for retirement funds. Your employee contribution is limited to $20,500 per year in 2022, with the option to make catch up contributions of an additional $6,500 if you’re over 50.

- Traditional Individual Retirement Accounts (IRA)

A traditional individual retirement account (IRA) lets you contribute pre-tax money and can be invested in various assets. However, there are some key differences between an IRA and 401k. Specifically, you’re not limited to investing in the options offered by your employer. With an IRA, you can have your retirement money invested in various assets, including stocks, exchange-traded funds, bond funds, and mutual funds.

Like a 401k, traditional IRA contributions are tax-deductible, which reduces your current taxable income. There is also an annual IRA contribution limit that you must follow, but a 401k has significantly higher contribution limits than the $6,000 you’re allowed to put in your IRA each year. If your 50 or older, you can make an additional $1,000 catch up contribution to your IRA. These limits apply to the total amount you contribute to both a traditional and Roth IRA.

- Roth Individual Retirement Account (IRA)

A Roth IRA is another retirement investment account that offers tax advantages. Unlike a traditional IRA, Roth IRA contributions are made with after-tax money. However, with a Roth IRA, the money grows tax-free, and you can withdraw your money tax-free in retirement.

This makes a Roth IRA an excellent choice for investors who expect to be in a higher tax bracket in retirement than during their working years. Smart retirement investing strategies often involve keeping some money in Roth accounts and some in traditional accounts for a variety of tax advantages.

- Stocks & Mutual Funds

When you buy shares in the stock market, you become a part-owner of the company and are entitled to a portion of the profits (or losses). Owning stocks allows you to participate in the growth of companies, which can lead to substantial gains over time.

Dividend stocks can provide regular investment income over time. Mutual funds allow you to own multiple companies by buying just one stock. Often, mutual funds outperform individual stocks. On the other hand, something like an international stock fund can be subject to more market volatility in the short term but will help you diversify your investment portfolio.

- Bonds

Bonds are a type of investment representing a loan made from an investor to a borrower. Borrowers can include federal and local governments. Typically, the borrower agrees to make interest payments to the investor over a predetermined period in return for the money loaned.

At the end of the term, the borrower also repays the original loan amount. You can include bonds in your investment portfolio to provide stability and income during retirement.

- Exchange-Traded Funds (ETFs)

An exchange-traded fund is one of the investment options that owns a basket of assets, such as stocks, bonds, or commodities. Exchange-traded funds are traded on stock exchanges and can be bought and sold like stocks.

One of the advantages of including ETFs in your retirement account is that you can buy partial shares of a company, unlike stocks. Additionally, because ETFs are traded on stock exchanges, they can be bought and sold throughout the day.

- Dividend Reinvestment Plans (DRIPs)

Using Dividend Reinvestment Plans, or DRIPs, is one investment strategy that can help you grow your retirement savings. DRIPs allow you to reinvest your dividends, which are payments made by a company to its shareholders. By reinvesting your dividends, you can buy more stock shares, leading to greater profits over time. Additionally, reinvesting your dividends can help you compound your gains.

- Defined-Benefit Plans

Defined-benefit plans, such as a simplified employee pension, are retirement plans that provide a guaranteed stream of income in retirement. Your years of service and salary history are considered in the formula used to determine the compensation.

One of the advantages of a defined-benefit plan is that it can provide a reliable source of income in retirement. However, these plans are becoming increasingly rare, so you may want to consider other retirement savings plans.

Retirement investment tips

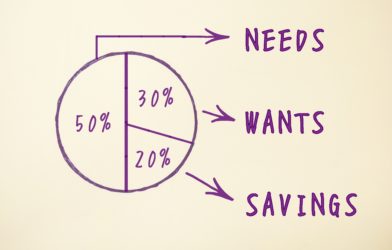

To make the most of your retirement investments, it’s essential to have a clear understanding of your goals and risk tolerance. Additionally, you’ll want to diversify your portfolio and have more retirement savings accounts to help mitigate the risk of losses.

- Start investing early

One of the best ways to boost your retirement investment is to start investing early so your money will grow. Starting early can help you take advantage of compounding when your earnings are reinvested and grow over time.

- Check investment fees

You must be mindful of your investment fees because they can reduce your returns. When choosing an investment, consider the expense ratio, which is the percentage of your assets you’re paying in fees.

- Take the tax deduction

Be sure to use the tax benefits of investment vehicles like IRAs and 401ks if you fall within the income limits. If you invest in a 401k directly from your paycheck, you receive an upfront tax deduction. You’ll still need to pay income taxes on your withdrawals in retirement but ideally your income tax bracket is lower then.

With Roth accounts, you can contribute with after tax dollars, which gives you a double tax advantage in retirement, since you don’t pay taxes on the growth of Roth investments, and you also don’t pay tax on the amount you withdraw.

The bottom line

Take your time: When it comes to finding where you want to invest for retirement, doing your homework is key. There are plenty of retirement investment options available, so it’s essential to understand your goals and risk tolerance before choosing an investment path. Before making investment decisions, consider the risks and fees of the mutual fund, exchange-traded fund, or annuity you’re considering.

It’s recommended that you save 10 times your income in order to retire comfortably at 67. Therefore, it is vital to have a retirement savings plan in place as early as possible. The sooner you start saving, the better prepared you’ll be for your financial future.