Over one in four parents of prospective college students feel like their kid isn’t ready for college. While that may not sound surprising, parents are also sharing that they themselves aren’t ready to pay those tuition bills either!

Specifically, a new study finds parents feel like their kids aren’t prepared for the academic load (54%), the mental stress (49%), or the emotional load (44%) that comes from higher education. On top of that, seven in 10 parents are feeling nervous about paying for college this year due to the financial impact of COVID-19.

The survey of 2,000 American parents of children entering college or current college students reveals 76 percent have begun talking with their kids about paying for school. Commissioned by College Ave Student Loans and conducted by OnePoll, researchers discovered, on average, parents expect the full cost of college — including tuition, books, room and board — to be above $26,000 annually.

Take the time to talk about finances

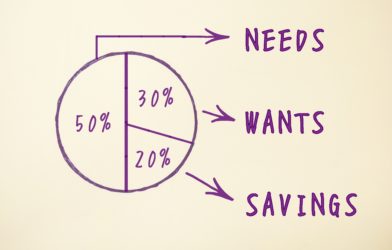

More than four in five parents with kids in high school (87%) have talked with them about the transition into college. Those talks include good study habits (80%), time management (69%), and budgeting (62%). A fifth of parents surveyed (21%) said they would cover more than half of their kid’s college expenses. Meanwhile, just over two-thirds (68%) expect their kids to foot up to a third of the bill themselves.

Optimistically, 57 percent of American parents are confident their kid has some knowledge about how to best manage their collegiate budget.

“College is one of the biggest investments for the child’s future,” says Joe DePaulo, CEO and Co-Founder of College Ave Student Loans, in a statement. “Creating a plan as a family on how to pay for higher education costs can set up the child for success now and for the years to follow.”

For families looking to save and budget money, two-thirds of parents agree applying for scholarships (66%) or living at home (65%) are the best ways to save. The average prospective student will apply for three scholarships to help pay for their college. If they plan on attending a four-year university, they’ll apply for an average of four scholarships.

Would you like fries with that college degree?

On top of scholarships, two-thirds said their kids are either planning to or already have a part-time job to help pay for school. However, 63 percent worry their kid’s job won’t be enough to put a dent in college costs. Over a third of parents (35%) said they feel like they’re already out of options when it comes to paying off that big tuition bill.

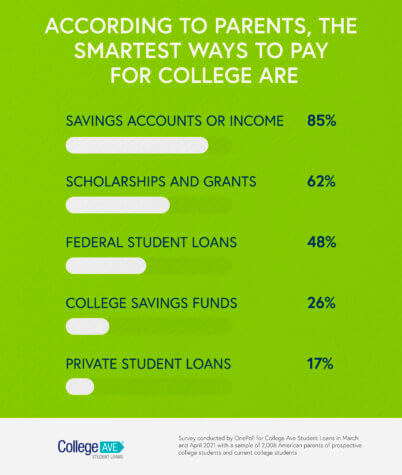

To get the best financial advice possible, parents are turning to college financial aid offices (49%) and internet research (32%) to see what other options are available. Scholarships aside, parents believe things like savings accounts (85%), federal student loans (48%), college funds (26%), and private student loans (17%) can all play a role in paying for college and saving personal costs.

“When looking at ways to pay for college, make sure to exhaust all financial aid options available, including scholarships and grants,” DePaulo adds. “If you find your family still has a gap to cover after scholarships, grants, savings and income, student loans are one option to explore. Make sure to look at federal student loans in the student’s name first — as those come with unique benefits, such as loan forgiveness and income-based repayment plans — before exploring private student loans. Always shop around for private student loans with good rates and flexible repayment plans that fit your budget and financial goals.”