Buying and holding the best dividend stocks is a proven way to build your savings and generate wealth over the long term. In this guide, we will explain the basics of dividend investing and why it is one of the very best strategies you can implement to become wealthy.

What is a Stock Dividend?

When a company makes a profit, it can do several things:

- Invest the money to grow the business

- Retain the profits in the business

- Pay off debt

- Distribute the profits to shareholders

- A mix of the above

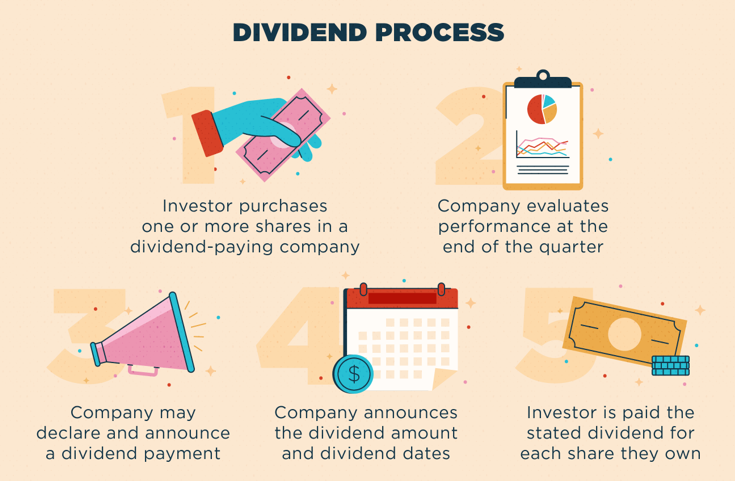

The distribution of profits to shareholders is called a dividend payment. Usually, a dividend-paying company will declare a dividend per share at regular intervals. While most companies pay dividends on a quarterly basis, there are dividend stocks that pay monthly, semi-annually or annually.

For example, American telecommunications firm AT&T – considered one of the best dividend stocks in the world – recently declared a quarterly dividend payment of $0.278 per share. This means that all shareholders on record can expect to receive $0.278 for every AT&T share they hold. If someone holds 100 shares, they will receive $27.80.

While most companies commit to a regular dividend payment schedule, others choose to pay them sporadically, only when they post exceptional financial results. Indeed, some companies prefer to pay down debt or reinvest the profits to fuel future growth.

If you are interested in stock dividends, there are certain terms you should familiarize yourself with. They will prove useful when you are comparing different dividend-paying stocks.

The Dividend Terms You Should Know

Here are four important dividend terms you should understand.

- Dividend Yield

The dividend yield is the annual dividend per share divided by the current stock price. This metric measures the return on investment you can expect to receive if you buy a given dividend stock today.

Of course, stock prices fluctuate daily. Thus, the dividend yield also fluctuates along with the stock price.

For example, if a stock is trading for $100 and pays a $1 yearly dividend, the dividend yield is 1%. If the stock price falls to $90, and the yearly dividend remains $1, the dividend yield has risen to 1.11%. If the stock price rises to $110 and the yearly dividend remains $1, the new dividend yield is 0.90%.

The dividend yield formula is:

Dividend Yield = Annual Dividends Per Share / Price Per Share

Should you only invest in dividend stocks with the highest dividend yields?

This is one of the first questions beginners ask when it comes to choosing dividend stocks.

Unfortunately, dividend stocks with high yields are not necessarily the best dividend stocks.

Indeed, a dividend stock might have a high yield because most investors are selling it. If you buy the stock just because it has a high yield, you run the risk of investing in a poorly managed company. If the dividend becomes unsustainable, the board will either cut or eliminate it, and you will be left holding a stock with a declining price and no dividend to compensate.

In the worst case scenario, the company will declare bankruptcy and you will lose 100% of your investment. Thus, dividend stocks with high yields are not always the best dividend stocks to invest in.

- Dividend Growth Rate

The dividend growth rate measures how much the dividend is increasing every year. Ideally, you want to invest in companies whose dividends are increasing every year, since this usually means the company’s financials are improving.

In theory, the higher the dividend growth rate, the better the dividend stock. However, if a dividend is increasing too much, it may become unsustainable.

This is why the next metric is very important.

- Payout Ratio

The dividend payout ratio measures the percentage of a company’s profits that are paid as dividends. A payout ratio of 50% means the company is distributing half of its profits to shareholders.

Much like the dividend yield, a high payout ratio is not always a good thing. If a company is paying 90% of its profits as dividends, it has little left over to invest in growth or pay back its debt.

The payout ratio is calculated as follows:

Dividend Payout Ratio = Annual Dividends Per Share / Earnings Per Share

- Consecutive Years of Dividend Growth

Lastly, you want to invest in companies that have a proven track record of paying dividends. The best dividend stocks are those of companies that able to find the right balance between paying dividends and growing their business. The longer a company is able to sustain dividend payments, the more reliable it is.

What Are The 10 Best Dividend Stocks?

At writing, the following dividend stocks are considered to be among the best in the world. Indeed, all of them have increased their dividend payments at least once a year for at least 50 consecutive years!

Their immaculate track record puts them in a category called the “Dividend Kings”.

| Company Name (ticker) | Stock Price | Annual Dividend | Dividend Yield | 5-year Dividend Growth | Payout Ratio | Consecutive Years of Dividend Increase |

| American States Water Co. (AWR) | $84.42 | $1.46 | 1.73% | 8.94% | 55.78% | 66 |

| Dover Corp. (DOV) | $143.00 | $2.00 | 1.40% | 7.27% | 25.84% | 66 |

| Procter & Gamble Co. (PG) | $161.25 | $3.65 | 2.27% | 5.48% | 60.72% | 65 |

| Emerson Electric Co. (EMR) | $93.60 | $2.06 | 2.20% | 1.33% | 46.99% | 64 |

| 3M Co. (MMM) | $149.17 | $5.96 | 4.00% | 5.65% | 58.50% | 63 |

| Cincinnati Financial Co. (CINF) | $136.66 | $2.76 | 2.02% | 5.87% | 39.31% | 61 |

| Coca-Cola Co. (KO) | $65.25 | $1.76 | 2.70% | 3.66% | 72.10% | 59 |

| Lowe’s Co. (LOW) | $197.06 | $3.20 | 1.62% | 17.98% | 25.06% | 59 |

| Colgate-Palmolive Co. (CL) | $81.10 | $1.88 | 2.32% | 3.00% | 55.94% | 58 |

| Johnson & Johnson (JNJ) | $181.54 | $4.52 | 2.49% | 5.79% | 42.91% | 59 |

As you can see, these are not dividend stocks with high yields. Indeed, since they are highly reliable dividend payers, investors are willing to pay a premium for this safety, which drives the stock price up and the dividend yield down.

Again, dividend stocks with high yields are not necessarily the best dividend stocks!

However, some of these companies also have a high dividend growth rate, which means investors can expect their dividends to increase substantially every year. This is one of the major appeals of the world’s best dividend stocks.

What About Dividend ETFs?

An Exchange-Traded Fund (ETF) is a type of pooled investment that resembles a mutual fund. However, contrary to mutual funds whose mandate is beat a particular benchmark, an ETF’s main objective is to passively track the performance of an underlying index, such as the S&P 500 or the Dow Jones Industrial Average.

Some ETFs invest exclusively in the world’s best dividend stocks.

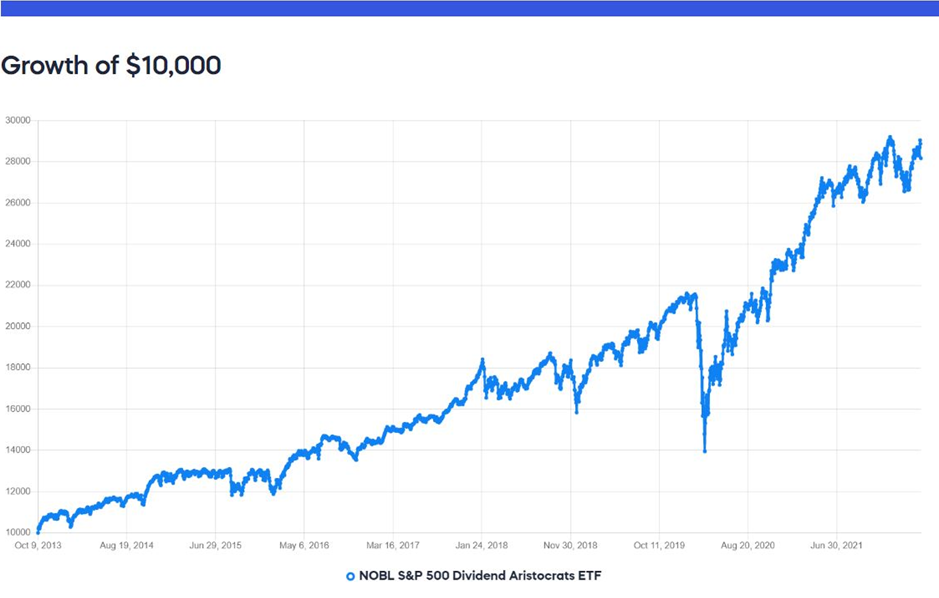

For example, the Proshares S&P 500 Dividend Aristocrats ETF (ticker: NOBL) invests only in companies that have grown their dividends for at least 25 consecutive years. These stocks – referred to as “Dividend Aristocrats” – have a history of stable earnings, solid fundamentals and demonstrated capacity to generate profits and growth.

You would now have $28,165, a 181% total return on investment in less than 10 years.

This ETF’s portfolio includes household names such as Stanley Black & Decker, The Sherwin-Williams Company, Clorox Company, Walgreens Boots Alliance Inc, McDonald’s Corp, Pepsico Inc, Caterpillar Inc, Automatic Data Processing, and Walmart Inc, among others. It is easy to see why it is regarded as one of the best dividend stocks ETFs on the market.

The advantage of investing in a dividend ETF is that you obtain great diversification without having to manage the portfolio yourself. The investment firm rebalances the portfolio for you, in exchange for a 0.35% expense ratio. If you bought and sold these dividend stocks individually, your brokerage commissions could be more expensive, and the time spent managing your portfolio would also add up. For these reasons, many investors choose to invest in dividend stocks ETFs rather than individual dividend stocks.

What Trading Accounts Can I Use to Buy Dividend Stocks and ETFs?

You can buy dividend stocks and ETFs in any type of investment account, including Roth IRAs, 401Ks, and standard online brokerage accounts.

However, you should note that dividends are taxable, so it is preferable to hold dividend stocks in tax deferred or tax free accounts, in order to maximize the benefits of dividend reinvesting.

What is Dividend Reinvesting?

The best way to approach dividend investing is to systematically reinvest every single dividend payment to purchase additional shares of the company or fund that pays them. This strategy is commonly referred to as dividend reinvesting.

Some companies and brokers offer a Dividend Reinvestment Plan (DRIP) that enables you to automatically reinvest your cash dividends to purchase additional shares or fractional shares of that company or fund. One big advantage of this strategy is that the automatic purchases are usually commission-free.

Here is how dividend reinvesting works.

Imagine you own 100 shares of AT&T stock. When the quarterly dividend of $0.278 per share is paid, you would receive a $27.80 cash payment. However, since you signed up for the DRIP, this money would be automatically reinvested to purchase additional shares. If the stock trades for $20 at the time you receive the dividend payment, you would now own 101.39 shares.

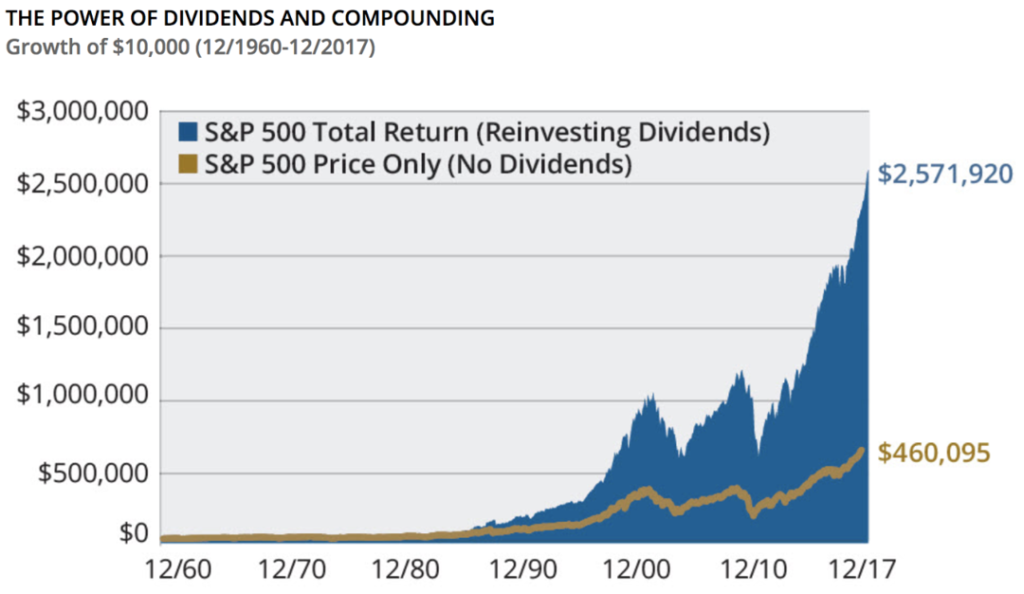

The benefit of this strategy is that dividends compound over time. Compounding occurs when you generate interest on the interest already earned. Over long periods, this generates exponential gains.

Let’s return to our example.

Remember, you now own 101.39 shares.

Imagine that the next quarter, AT&T declares a dividend per share of $0.30. You would receive a cash payment of $30.42, which would be automatically reinvested. If the stock is trading for $20.50, you would now own 102.87 shares. If the next quarterly payment remains the same, you would receive another dividend payment of $30.86 – based on the 102.87 shares you own – which would again be reinvested.

This process continues until you decide to sell the stock or opt out of the DRIP.

When Should I Cash Out My Dividends, Stock or ETF?

Ideally, you should hold your dividend paying stock for as long as possible. Indeed, while compounding can generate exponential gains, it doesn’t happen overnight. You usually need to stay invested for 20+ years for this strategy to pay dividends (no pun intended!)

In the best case scenario, you should only cash out when you are retired and need the dividend income to complement your lifestyle. Otherwise, you should let the dividends work for you for as long as possible. However, there are other scenarios where cashing out the dividends makes sense. For example, if the company is experiencing financial difficulties, the board may consider reducing or eliminating the dividend. In this case, you should consider selling the stock. If the cut is temporary and the company’s future prospects are good, you can hold on to the stock. If the company is in serious trouble, you should probably sell the stock and invest your money elsewhere.