Saving money is a must for young adults who want to build themselves a safe and sound future. That’s especially the case for those with growing families and the need to put aside enough cash to move into bigger and better digs. But many millennials haven’t been given the proper financial education when it comes to saving money. Others simply don’t know where to begin now that they have a steady cash-flow coming in from their job.

Look, there’s no magic formula to make you immediately better at saving money if you don’t know how and struggle with spending. But the process shouldn’t be as scary as it might feel. Going to your local library and taking out books on money management is a great place to start, but we wanted to wet your whistle with some ideas on ways to kickstart the process.

Here’s a look at five easy ideas to consider if you’re a millennial looking to improve your savings and money management.

Budgeting

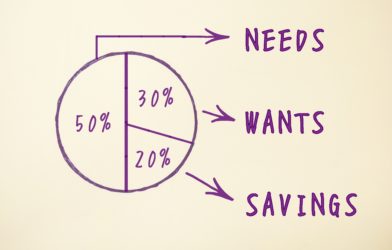

A budget is a must for any millennial. It doesn’t matter if you have a steady and high-paying job or you’re barely making ends meet with your current salary, budgeting is key to your financial future. Budgeting helps you balance your spending, so that you don’t go broke. It also forces you to choose between things like entertainment and savings, so that you can live within your means.

You must to set a realistic goal and start living within the limits of what your budget tells you. This process can feel daunting, but here’s the key to make it a habit: start easy. Create a budget you know you can follow right away and stick to it. That might mean making just one daily change to your spending habits. When you’ve got that down, rinse and repeat — by adding another segment to your plan.

The more you make budgeting a habit, the easier it will be to budget more and more areas of your life. It’s better to be safe than sorry!

Automate your savings

One of the best ways to start saving money is to automate it. By automating your savings, you take the worry and stress out of putting money away into your savings account.

You can set up an automatic transfer each month or week to add a set amount to your savings. It’s a small commitment that could lead to big rewards down the line.

Find ways to make more money

If you’re struggling to save money it might be because, simply put, you’re not making enough. It can be easy to spend on things that don’t matter when you’re not making enough money. But if you want to start saving, one of the best ways is to find ways to make more money!

One idea is to create a side hustle. A side hustle is a “side” job or small business that brings in some extra side income. You can do this by selling items on eBay, using sites like TaskRabbit, or even teaching online classes. It’s a great way to expand your income and start saving more right away!

You could also try negotiating your salary at work. There are many reasons why asking for a raise can increase your earnings: companies have an incentive to retain employees; people who negotiate their salaries have higher incomes than those who don’t; negotiation skills are good for other aspects of life like relationships and finances; and employers may be willing to hire people who negotiate their salaries because they know they’ll stay with the company longer. All these reasons are good enough for us!

Plan ahead for purchases

One of the first steps to take is planning ahead for purchases. Look at your expenses and figure out where you can save.

If you want to buy an apartment, for instance, start saving now so that when you are ready for a down payment, you have the money saved up instead of relying on a loan or credit card. Make a list of expenses you know you will have in imminent future. Write down how much you will need to save, and synch this with your daily budgeting goals.

Invest wisely

One of the most common mistakes millennials make when it comes to investing is not investing at all. Millennials are more likely than any other age group to invest in their company’s stock and neglect other investments.

If you want to invest successfully, it’s important to do your research. You should look for a low-cost index fund that tracks the market. These funds are easy to find and manage, which means less time managing your account. Your investments should be diversified, meaning you shouldn’t put all your money into one place. If you invest wisely, you can start saving money as a millennial today!